How the tables have turned. Historically, Chinese cars were nothing to write home about and Chinese car companies relied heavily on know-how shared with them by Western, Japanese and Korean partners. Now, China is the world’s biggest exporter of cars and the rest of the world is scrambling to understand how its homegrown car companies manage to make EVs that are so cheap, so good and so quick to market.

Because Chinese juggernauts like BYD and Geely are already storming into Europe and South America, and there’s good reason to believe the U.S. is next.

Automakers from Ford to Rivian have bought and benchmarked Chinese EVs to uncover their secrets—a common practice across the auto industry.

Lucid Motors has also been testing and tearing apart Chinese cars to better understand and learn from the competition, the startup’s chief engineer, Eric Bach, told InsideEVs in a recent interview. They have a lot of strengths, so it would be silly to ignore that, he said—especially as the firm ramps up new offerings like the Gravity SUV and upcoming affordable models.

23

Lucid Motors

“They’ve got core strengths in the digital realm,” Bach said. “They’ve got enormous speed capabilities and incredible work ethic that gives them a lot of product. And they’ve got government subsidies, obviously, that have created a huge competitive drive in China. And they’re about to try to figure out how they go global.”

“So if you’re not aware of that, that would be living in oblivion and not right,” he said.

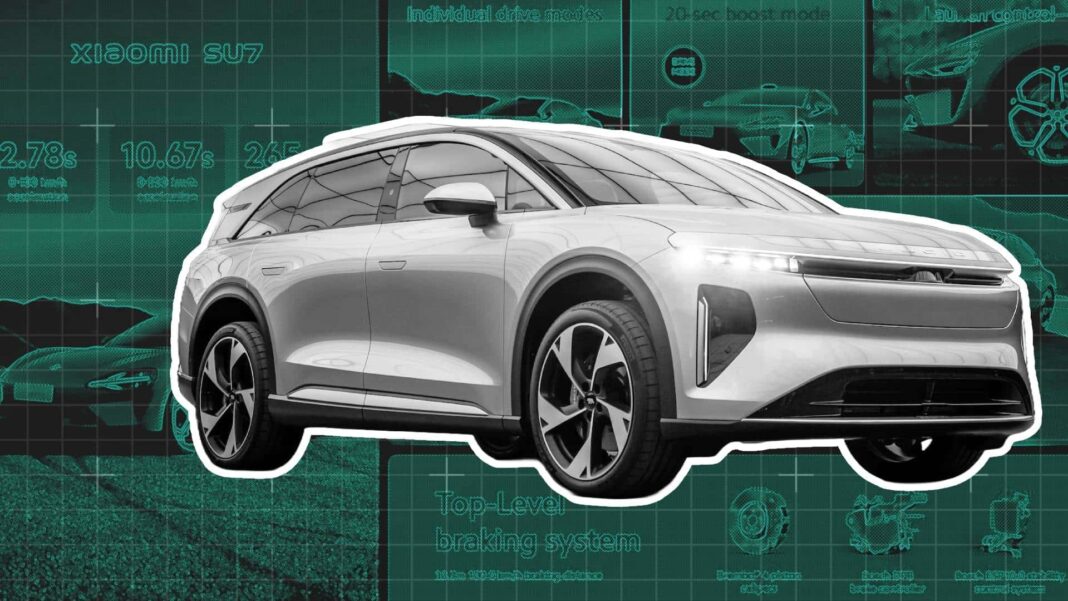

The company has a Nio and a Zeekr, and has ordered a Xiaomi SU7, David Lickfold, who leads Lucid’s vehicle dynamics team, told us this month. Bach said each Chinese brand has its strengths and weaknesses.

Generally speaking, though, Chinese automakers are crushing it in two key respects. One that may be surprising to some is craftsmanship.

“If you look at the maturity and the refinement of the exterior body or the interiors, you can find some of the competitors there showing a very high standard of execution,” Bach said. “And I think it is really important to acknowledge that the Chinese competition is not bad in terms of quality.”

One model that exemplifies that is the SU7, he said. Consumer-technology company Xiaomi’s first-ever vehicle has proven extremely popular in China and has come to symbolize, in a sense, what China is capable of. The four-door Porsche Taycan lookalike—sometimes called “China’s Apple car”—recently got heaps of praise from Ford CEO Jim Farley.

China is also excelling in terms of digital features and infotainment software, Bach said, adding that Lucid is working to go that direction with the Gravity, its SUV that just started production. That vehicle has a sprawling curved display and a brand-new infotainment system that addresses some of the clunkiness of Lucid’s previous software.

The interior of a Ji Yue car.

“What [Chinese firms] have, maybe a little bit more, is more people that are programming at more hours per week, seemingly, and therefore the output is really, really high,” he said. “And we need to measure ourselves there and strive to be as quick and as imaginative.”

Ji Yue, a joint effort from the Chinese auto group Geely and tech firm Baidu that makes vehicles it calls “robocars,” impressed him with its digital experience, and in particular its navigation, voice command and advanced driver-assistance systems. (That firm has since run into trouble of its own, proving yet again that while Chinese automakers are impressive, they’re not invincible—or above the same problems that can affect many EV newcomers.)

Where Chinese firms tend to come up short is in driving dynamics and performance, Bach said.

“I think the whole package comes together only at Lucid, and we were going to work really hard to keep it that way,” Bach said.

He has to. Because while the Chinese automakers are kept at bay in the U.S. by tariffs and regulations for now, that may not be the case forever—and Lucid could face its most intense, direct competition at a time when it’s still trying to ramp up mass-production of its most important EVs.

Contact the author: [email protected]