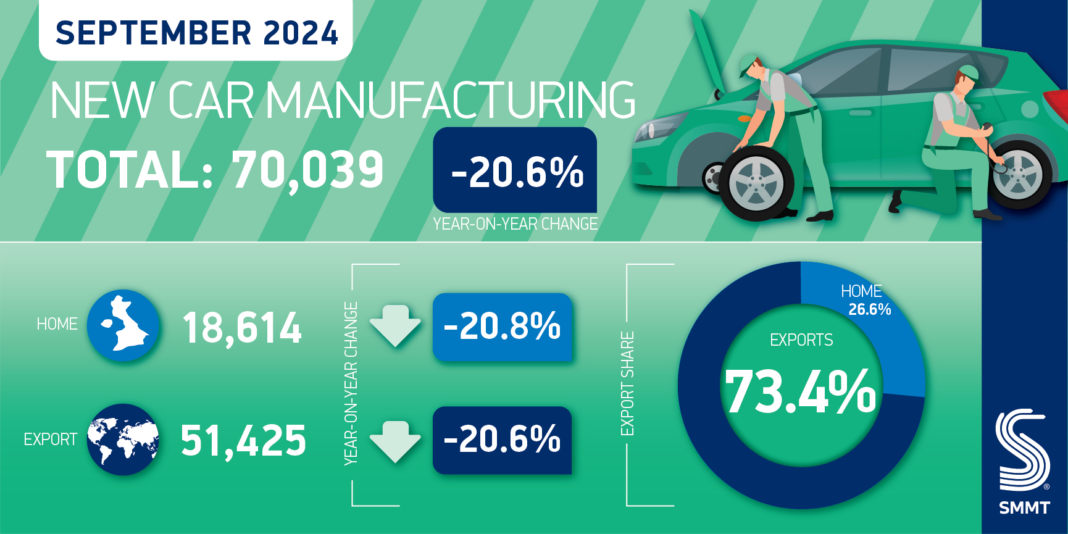

UK car production output declined by -20.6% in September, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT) as 70,039 units rolled off production lines

UK car production output declined by -20.6% in September, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT) as 70,039 units rolled off production lines. The scale of the decline is, in part, exacerbated by comparison with a strong September 2023, which saw the best result for the month since 2020.

The decrease was largely expected as factories wind down production of current models and retool lines for all-new zero emission vehicles. Some 21,309 electrified models1 were made in September, representing 30.4% of all cars produced despite an overall volume decline of -37.0% against the same month last year.

Output for domestic and export markets saw almost identical rates of decline, down -20.8% to 18,614 units and -20.6% to 51,425 units respectively. Continuing the trend as Britain’s leading market for finished vehicles, the EU took more than half (52.2%) of exports at 26,825 units, although volumes fell -28.6%. Exports to China, one of the top three export destinations, fell too, down -23.1% to 3,673 units and taking 7.1% export share, while those to the US rose 24.6% to 8,210 units and representing 16.0% of September’s exports.

In the year to date, a 6.5% rise in output for the UK was not enough to offset a -14.4% fall in overseas shipments, given the export-led nature of the sector, meaning overall UK car production is down -10.2% to 592,862 units, since January. Growth is expected to return once new models come on stream, with car and light van production forecast to head back above one million units in 2027 and with the potential to surpass 1.3 million by 2030.2

The news comes as fresh SMMT trade data analysis details how, despite a drop in car production this year, the sector remains Britain’s largest exporter of manufactured products, increasing its share of these exports to 13.9% in the first half of 2024.3 The value of these exports has remained consistently high, driven by global demand for premium UK-made electrified vehicles, which are worth roughly one and a half times more than ICE models.4 Moreover, in the 12 months to June, the sector was worth £114 billion in total trade, encompassing £46.8 billion in exports and £67.2 billion in imports.5

Mike Hawes, SMMT Chief Executive, said,

As UK Automotive undergoes its most radical transformation in more than a century, short term production declines were always anticipated, and they represent a temporary adjustment in exchange for long term growth. Following record investment announcements last year, the sector is ready to build on its position as the UK’s largest exporter of manufactured products. To do so, we need the necessary industrial and market conditions, and the forthcoming Budget and Industrial Strategy must put in place ambitious measures to bolster business confidence, attract investment and secure competitiveness.

To ensure the industry’s hugely important contribution to UK economic growth can continue, and grow, SMMT is calling for the Autumn Budget to include the incentivisation of private consumer demand for battery electric vehicles, which would accelerate market transition and stimulate industrial growth. In addition, the funding secured within last year’s Advanced Manufacturing Plan should be reaffirmed; access to competitively priced low carbon energy secured; and measures introduced to encourage investment, especially in the zero emission powertrain supply chain and skills.

Policymakers should also work with industry to:

- Develop an industrial strategy with automotive at its heart

- Secure fresh investment in electrification and battery manufacturing to foster EV trade with the EU and rest of the world

- Fine tune the forthcoming trade strategy with domestic industrial objectives

- Maintain automotive trade openness as an engine for future growth

- Continuously improve the UK’s trading relationship with the EU, our closest trading partner

- Seek reduction of tariff and non-tariff barriers in trade with key markets

- Reduce customs-related operational costs

- Improve trade data availability and transparency, including on the utilisation of free trade agreements

SMMT data is subject to periodical revision if additional information becomes available.

- Electrified vehicles consist of battery electric, plug-in hybrid and hybrid models

- Independent production outlook for cars and light vans only– July 2024

- SMMT Trade Snapshot based on ONS / HMRC / SMMT data – produced October 2024

- Electrified vehicle and internal combustion engine economic value based on rolling year, June 2024: EV: £17.2bn; ICE: £12.2bn

- SMMT Trade Snapshot based on ONS / HMRC / SMMT data – produced October 2024, based on 2023/2024 data

SOURCE: SMMT