AE Elemental has opened its first battery recycling facility in Poland, but can it help Europe decouple itself from China? By Stewart Burnett

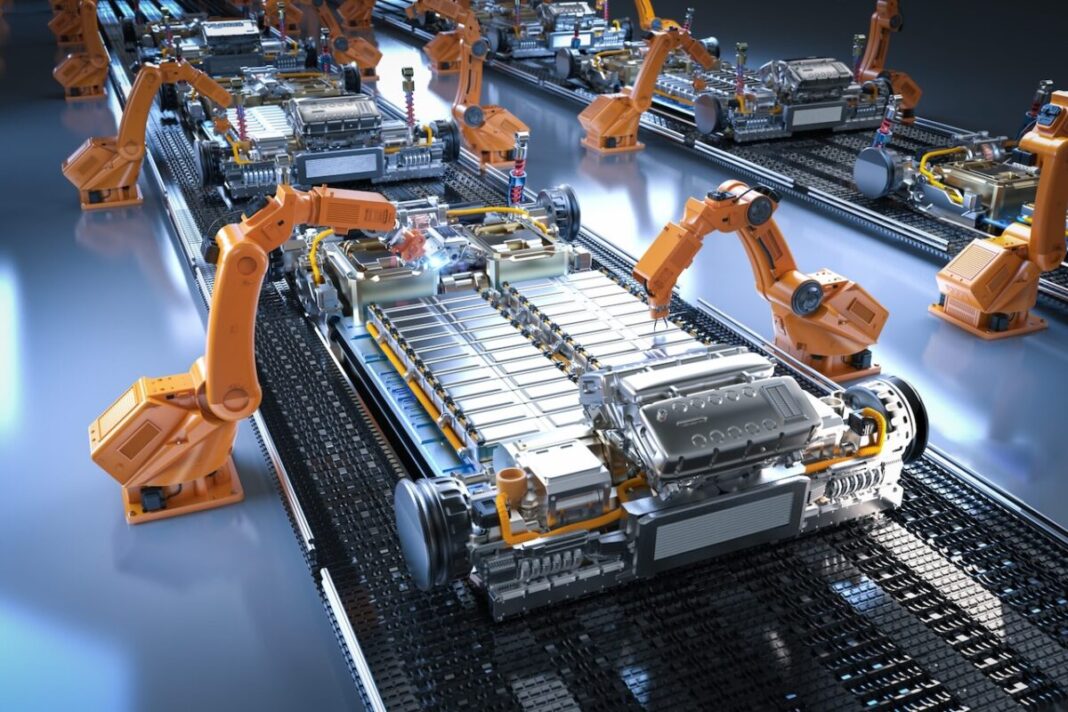

Millions of batteries will be required to scale electric vehicle (EV) production volume to match mass market demand. The EU and the UK have both set hard targets for EVs to account for 80% of light passenger vehicle sales by 2030 and 100% by 2035. The US is aiming for 50% of all new passenger vehicle sales by 2030. At the same time, both the EU and the US are looking to decouple their supply chains from China, which currently dominates the production of lithium-ion batteries.

BloombergNEF reported in April 2024 that China already makes enough batteries to supply the entire world, with an annual production capacity equivalent to 900 GWh, or 77% of the global total. China dominates both the procurement and refinement of raw materials for lithium-ion. If Western automotive players want to circumvent China, they will need to do more with less. In practice, this means embracing the circular economy.

A circular economy for batteries promises to lower the emissions associated with EV production, but execution of the idea remains relatively nascent. However, some industry players are making significant progress, and AE Elemental is a case in point. The company opened its first commercial-scale EV battery recycling facility on 19 September 2024. The firm believes it can contribute to a more eco-friendly battery supply chain that is safeguarded against geopolitical disruption.

Why recycling matters

AE Elemental is a joint venture between the US-based advanced battery materials manufacturer Ascend Elements and Polish battery metal recovery firm Elemental Strategic Metals. The recycling facility, located in Zawiercie, Poland, will be capable of processing 12,000 metric tons of used lithium-ion batteries annually, equivalent to 28,000 EV battery packs.

“A lot of people are sceptical about buying an EV because they think the car will eventually be dumped somewhere in a field, nothing will happen with it, and then the environment will be contaminated because the battery is left to decay,” says Marcin Ślęzak, Chief Executive of AE Elemental. In other words, people are not convinced that EVs are as eco-friendly as they are claimed to be, and eco-friendliness is the entire point. This is partly why AE Elemental considers it so important to establish a circular economy for EV batteries: to dispel negative messaging and lingering doubts among the general public.

However, the biggest obstacle to electrification is scale. While several gigafactories are currently underway in Europe, raw material sourcing could experience bottlenecks should geopolitical disruption occur. China has warned it will retaliate to the EU’s and US’ increasingly steep tariffs on EVs and batteries, including threats to ban exports of raw materials entirely. Since 2023, it has imposed heavy restrictions on gallium, germanium and graphite, materials commonly used in semiconductors. “There’s a lot of instability around the world right now, and you don’t really know how it’s all going to turn out or how it will affect trade,” remarks Ślęzak. “You cannot plan for gigafactories without a recycling option.”

Efficient material processing

For the circular economy to be a compelling option for manufacturers, it must demonstrate its viability both in terms of quantity and sustainability. “With our technology, we can recycle and regain more than 90% of the strategic metals from batteries while remaining essentially environmentally neutral,” asserts Ślęzak. He is unable to offer precise details about the separation and recovery processes but instead highlights that the Zawiercie facility can be run entirely from a solar farm in an adjacent field. On cloudy days, it uses stationary storage solutions as a back-up.

Because it can operate independently from the main energy grid, Ślęzak believes this can cut a new battery’s production emissions down by around 50%. Currently, most battery-grade lithium is extracted from hard rock mines or underground brine reservoirs, with most of the energy used for extraction and processing coming from fossil fuels. For every tonne of mined lithium, 15 tonnes of CO2 are emitted.

While the majority of focus is currently given to vehicle emissions while in use, lifecycle emissions will become more important in future. Ricardo is currently working on an EU framework for vehicle lifecycle assessment (LCA) that will be published in June 2025. In addition, the EU’s regulations enforcing battery passports—which track, among other things, a battery’s lifetime CO2 emissions—take effect in 2027.

AE Elemental’s battery processing facility also aims to facilitate supply chain independence by refining the resulting black mass onsite. This remains a work in progress, with plans for onsite refinement to come online in 2026. “Our critical goal is to avoid exporting black mass to China and do it in-house,” remarks Ślęzak. In addition to lowering emissions and minimising reliance on China, it might also enable savings by removing logistics costs.

Strategic play

Ultimately, Ślęzak concedes, mining lithium straight from the ground will always be the less costly option. However, cost is not the only factor in play. “Bear in mind that recycling targets for batteries are going to become increasingly strict, we just have to make it as affordable as possible.” Starting in 2026, the ratio of recycled materials used in batteries will increase for the EU: 12% for cobalt and 4% for both nickel and lithium. By 2035, it will rise to 20% for cobalt, 12% for nickel, and 10% for lithium.

Our critical goal is to avoid exporting black mass to China and do it in-house

Given that EVs currently cost more than their internal combustion engine equivalents, this could increase sticker prices, thereby making EVs less accessible. Ślęzak counters that it is not the job of recyclers to make EVs more affordable. Instead, he tells Automotive World that this should be achieved through government grants and a stronger focus on smaller city cars rather than SUVs and the luxury segment.

For its part, AE Elemental is doing everything it can to help maximise sustainability and create economies of scale. In addition to its 12,000 tonne opening capacity, the Zawiercie facility can be expanded to 50,000 tonnes. Ślęzak highlights its central location between various automotive and battery manufacturing locations, including those in Hungary, Germany and the Czech Republic. While this will not be enough to satiate the raw material demand of all European players, it is a step in the right direction.

Looking towards the future, the company is planning more recycling facilities for Europe, including one in Germany with an opening capacity of 25,000 tonnes. This would make it the largest battery recycling facility in Europe. It also has an eye to continue iterating and developing its recycling technology to further boost material recoverability and energy efficiency.

EVs are here to stay and will become increasingly widespread, concludes Ślęzak, and recycling could prove essential in ensuring this occurs irrespective of what happens on the international stage. Therefore, the industry must collaborate on the expansion of recycling technology to ensure the EU’s electrification drive can match its sustainability promise while also safeguarding from geopolitical instability. Journalist in