- EV sales are predicted to increase sixfold by 2030

- Demand for EVs and battery materials, could account for 95% of lithium supply

- Reuse, recycling, and alternative chemistries could take pressure off supply chains

Increased global demand for electric vehicles could tax supplies of raw materials by the end of the decade, according to new analysis from McKinsey & Company.

The firm estimates that EV sales will increase sixfold, from approximately 4.5 million vehicles globally in 2021 28 million in 2030. But analysts believe producers of raw materials may have trouble keeping up with this increased demand.

For example, while McKinsey anticipates increases in lithium supply from the widespread adoption of direct-extraction technology in mining, that will be in parallel with an increase in demand from battery suppliers. They account for 80% of global lithium use today but that could grow to 95% by 2030, McKinsey estimates.

Stack of Rivian battery cells

If demand for NMC-chemistry EV batteries continues to grow, as McKinsey expects, that could also potentially lead to a shortage of nickel despite anticipated increases in mining of that metal as well. in this case, the battery industry competes against the steel industry (which uses nickel to make stainless steel), with both sectors expected to consume more nickel through the end of the decade, McKinsey notes.

That’s assuming NMC continues as the dominant chemistry. McKinsey acknowledges increased interest in LFP chemistry, and notes that an uptick in LFP battery cell production could change the supply scenario.

So could cultivation of additional sources of raw materials as part of efforts by the European Union and U.S. to increase domestic battery production. Although the latter’s policies could be changed by the incoming Trump Administration, throwing away what could be a cost advantage over China on battery production.

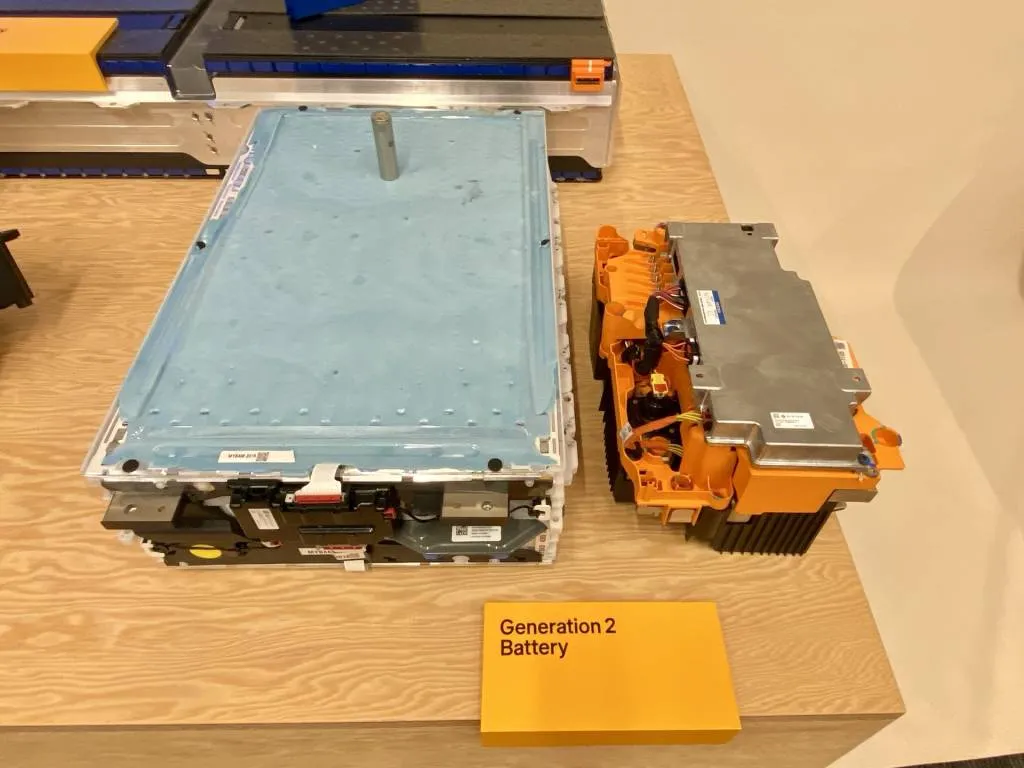

Rivian Gen 2 battery pack

Several companies are also looking at reuse and recycling of battery materials, as well as further alternative chemistries beyond LFP, that could come into play at a small scale before the end of the decade, potentially taking some pressure off the main raw-material supply.

Analysis that paints a positive picture of battery raw-material demand—and perhaps those seeking investment—might not surprise those familiar with McKinsey’s work. Goldman Sachs, on the other hand, reported in November that EV battery prices could drop 50% by 2026 in part due to decreasing prices for raw materials like lithium and cobalt. So even among some big names in analysis and forecasting, there are some very different ideas of what path the future might take.