There’s a good chance that whatever device you’re using to read this story runs off a battery made in China. And until very recently, that was true of a great many electric vehicles as well. That’s because the U.S., Europe, Japan and other parts of the globe spent decades outsourcing batteries and battery production to China for cost reasons. Then that country took this lead and ran with it to the point where it now accounts for more than 80% of battery manufacturing capacity, according to S&P Global.

Lately, the U.S. in particular has been playing catch-up. And the good news is that it seems to be working.

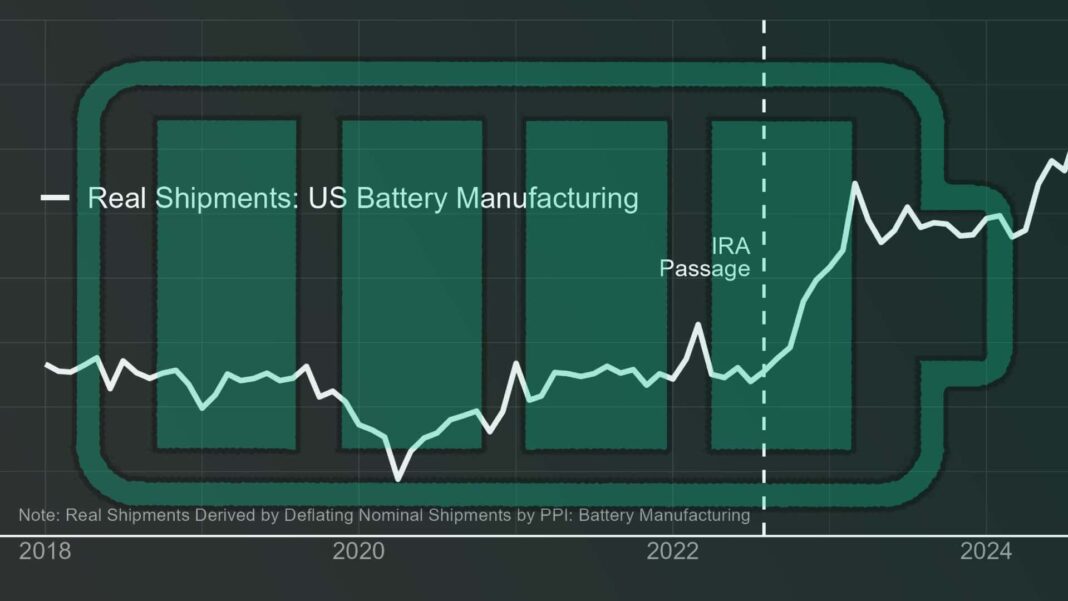

New details compiled last week by economic analyst and data journalist Joey Politano reveal that U.S. lithium-ion battery production has increased significantly in recent years, specifically since the passage of the Inflation Reduction Act (IRA).

Despite that legislation’s clunky name, it’s perhaps the most significant climate- and jobs-focused bills ever passed into law, packed with incentives to develop and manufacture green energy technologies—including batteries for EVs—domestically instead of abroad. In fact, according to Politano’s data, battery production is actually up 25% in the U.S. since 2023.

Politano told InsideEVs that his conclusion comes from two sources: the U.S. Census’ Manufacturers’ Shipments, Inventories, and Orders (M3) survey, and the producer price index for battery manufacturing from the Bureau of Labor Statistics. He tracks trends like these and more on his Substack as well.

His findings track with other studies we’ve seen that confirm this trend. According to International Energy Agency (IEA) data from May, China’s global investments in clean technology manufacturing and control of the battery space is actually down from 2022 and 2023. You can thank the rise in local manufacturing for much of that; investments more than tripled in the U.S. and Europe in 2023. It should also get even better when we can see the full data from this year; a full “40% of investments in clean energy manufacturing in 2023 were in facilities that are due to come online in 2024,” the IEA said in its report. S&P reports the U.S.’ investment in EV battery making was $40 billion between 2020 and the third quarter of 2023 alone.

Photo by: InsideEVs

This is true of battery use in the U.S. for our power grid as well. The Guardian recently reported that America has drastically ramped up the production and installment of huge backup batteries that can be used in power outages this year. “From barely anything just a few years ago, the U.S. is now adding utility-scale batteries at a dizzying pace, having installed more than 20 gigawatts of battery capacity to the electric grid,” the story said. “This means that battery storage equivalent to the output of 20 nuclear reactors has been bolted on to America’s electric grids in barely four years, with the EIA predicting this capacity could double again to 40GW by 2025 if further planned expansions occur.”

People tend to think of lithium-ion batteries purely in a car sense, but that’s only one part of what’s happening in America right now. Yet batteries and battery tech developments spread across the entire power space, and ramping them up here for use in cars is a great way to get things moving. This is how America gets good at doing so. Much of that in recent years has been tied to the IRA, which allowed automakers to offer a tax credit of up to $7,500 to purchase an EV if it, and its batteries, were made in North America. Since no automaker wants to compete against another without that advantage, battery factories are springing up all over the U.S. to support the EV sector—including in red and purple states.

Hyundai Motors Group Metaplant in Savannah, Georgia

That’s noteworthy here because now President-elect Donald Trump has vowed to repeal the provisions of the IRA, get rid of EV tax credits and incentives and claw back unspent funds. Whether he can is a question of open debate; killing all of the IRA would require an act of Congress, and many if not all elected officials would want to keep those EV and battery manufacturing jobs in their districts. Plus, the EV race is now a question of technological competition with America’s toughest geopolitical adversary. The car industry is certainly a big part of that, but it’s just one part; this race goes into almost everything that uses or will use electric power.

It’s true that the battery industry will very likely keep going on its own without subsidies. The demand for battery-powered devices isn’t going anywhere, and in the world of cars, sales of purely internal combustion vehicles peaked globally in 2017 and have been in decline ever since. But China invested a tremendous amount of national and regional funding into batteries, EVs and more; if the U.S. wants to have a shot at competing against such a giant and avoid becoming purely an importer of the world’s next-generation tech, the next occupant of the White House would do well to take note of what’s actually working right now.

Contact the author: [email protected]